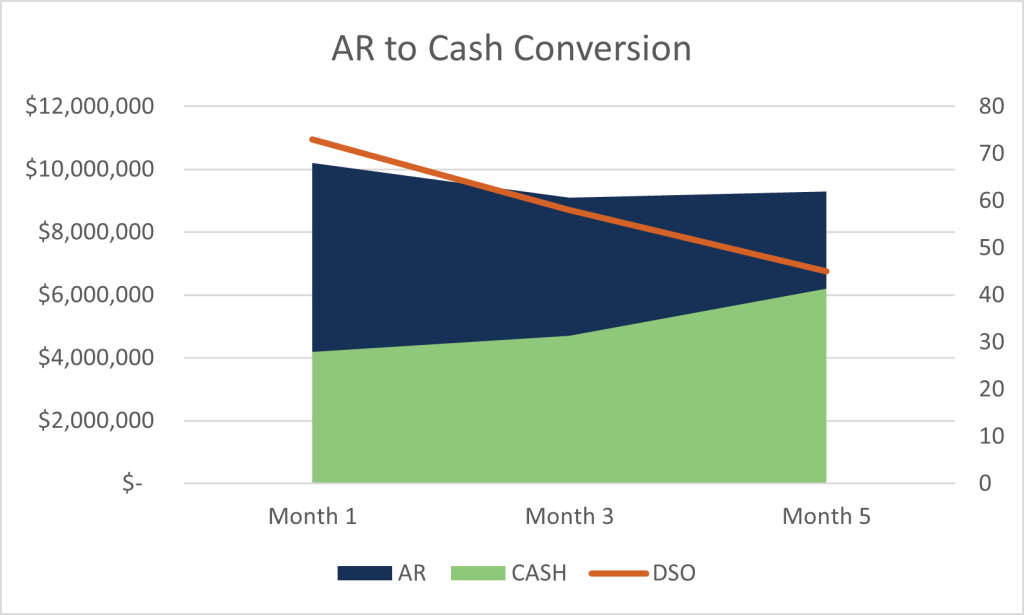

Application Integration and Automation Improves DSO 38%

Revtelligence Joins NetSuite Solution Provider Program

July 19, 2022

ERP Consolidation Decreases Operating Cost 55%

September 12, 2022Application Integration and Automation Improves DSO 38%

The Client

Client was a portfolio of globally respected learning, development, and performance improvement brands – cultural transformation and communication, sales transformation, democratized leadership development, project implementation and credit risk management. Brands that collectively generated hundreds of millions in revenue, serving thousands of organizations, including several Fortune 500 companies. Brands also included several New York Times best-selling books and award-winning training and development products used by millions of people in over sixty countries.

The Challenge

DSO (or the Days Sales Outstanding metric) is the measure of the average number of days that it takes a company to collect payment for a sale – or – how long it takes a customer to pay. The client’s DSO calculation was the ratio of accounts receivable over revenue times the number of days in the period.

Client had a DSO of 73 days due to inaccurate invoicing. Working with their finance team, it was determined that over 40% of first-time invoices were returned or contested due to these inaccuracies.

Client team members were manually translating the simplified CRM product catalog to coincide with the complex ERP product list, then manually moving this data to the ERP for invoice creation. These transfers of data were inconsistent among team members and the primary root cause of their extended DSO. The CRM and ERP systems were both capable of managing these processes, however, they were not installed or managed properly to assist with the business’s needs.

This problem remained for years, and client had no strategy to address it. Although a business process appeared to be followed, team turnover and lack of routine training created unmonitored issues. In fact, until the client’s customer alerted client of these errors, the client was unaware. Automated revenue stream monitoring did not exist.

There are many ways to reduce or improve DSO. This paper and example will focus on technology enhancements and automation from a recent client to achieve efficient cash collection.

The Opportunity

CRM to ERP Application Integration

The CRM and ERP systems of the client held separate silos of data and movement between each was manual. Cloud integration brought these systems together and two-way data flows were mapped to meet business objectives. Sales order data within the CRM moved to the ERP for invoicing without any human intervention and updates to an invoice were reflected in the CRM. As example, when an invoice was sent or fulfilled, the CRM order record was automatically updated with the change in status. The measurable impact to DSO replacing manual data movements with application integration was a 21% improvement. With a $10.2M account receivable balance and a 15-day improvement in cash collection, our client collected an additional $500,000 in available cash for the period.

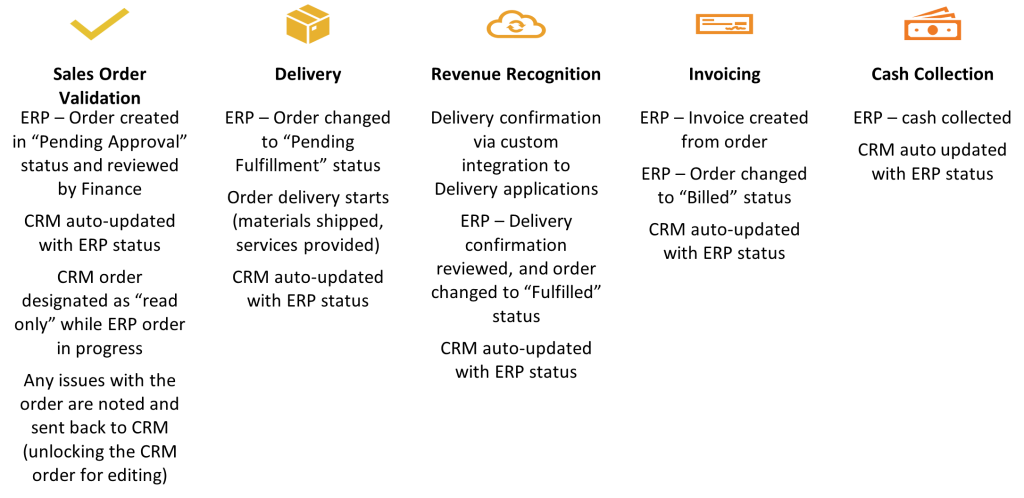

Order-to-Cash Business Process Automation

Further steps were involved to remove other manual processes for complete automation. Business processes were documented and used to create these data flows between CRM and ERP. Final automations included sales leads to orders to final revenue recognition and invoicing. Another 23% DSO improvement was realized because of these automations with an additional $2M in cash flow for the period. Complete revenue stream monitoring was deployed with real-time error handling and reporting. The client was able to maintain the 45-day DSO through the remaining year monitoring and measuring the KPIs for the project.

Integrated Data and Cash Flows

The following illustrates the data and cash flows for sales order and revenue to achieve these results:

The Outcome

In five months, our client realized a DSO improvement of 28 days or 38% and an additional cash flow of $4.9M of $10.2M in collectible revenue for the period. Due to the business outcomes of the program, the client awarded us several opportunities to automate other business processes. Business value was increased and further prepared the client for a successful exit.